Make sure you have a copy of the section of the insurance policy that mentions about the Covid-19 coverage.

Effective 1st May 2022, Covid-19 Travel Insurance is no longer required (Entry Requirements for Travelling to Malaysia)

However it is advisable to purchase travel insurance with Covid-19 Coverage for all the travellers as the virus is still very much a risk now.

*Langkawi Travel Bubble (LTB) – Discontinued

Things to take note

- Depending on where you buy the insurance from, websites and policies for the same insurance company can vary from country to country. It is better to purchase the insurance from your country of residence.

- The price of premium changes with age, the duration of coverage and the distance between where you travel from to the destination.

International Insurance

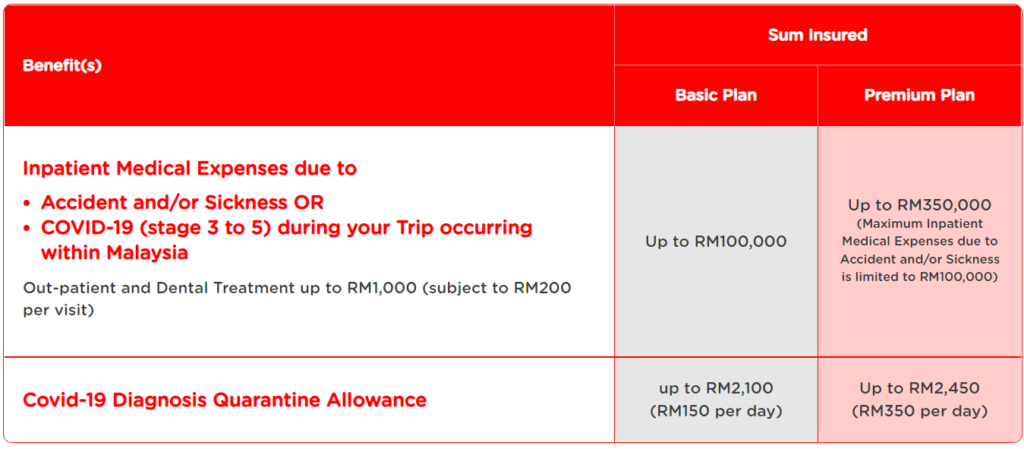

Tune Protect Covid Travel Pass+

Tune Protect COVID Travel Pass+ is one of the most talked-about travel insurance for Covid-19 medical coverage. It has the plan customized especially for foreign visitors to Malaysia. The travellers can just purchase the insurance online and they’re good to go. However, if your credit card is not equipped with 3D secure feature where an OTP is sent to your mobile for payment verification or it is not a Malaysian credit card, you may encounter problems with payment.

Basic Plan: Up to RM100,000 for Inpatient Medical Expenses due to Covid-19 (stage 3 to 5) during your trip in Malaysia – Price from: RM161.25 (30 days return trip).

Age: Up to 70 years old and

Max duration: 90 days

Tune Protect Reviews: I used tune protect, this is the easiest. It shows the amount covered for Covid which is important. Review Feb 22: Tune Protect does not seem to take US Credit card for purchase of the Covid Insurance.

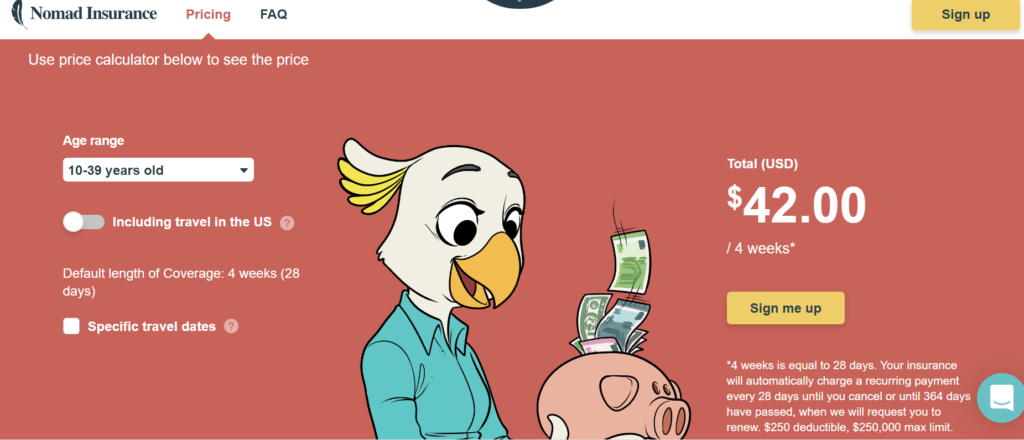

SafetyWing

Nomad Insurance: from USD42 (RM176) for 4 weeks. Your insurance will automatically charge a recurring payment every 28 days (4 weeks) until you cancel or until 364 days have passed, when SafetyWing will request you to renew.

FAQ: Coverage for Covid-19 works the same as any other illness. Covers quarantine outside your home country of USD50/day for up to 10 days.

Coverage: Age 65 to 69: USD100K. Others: Up to USD250k (RM1 Million)

Age: up to 69 years old

I can recommend Safetywing for insurance. It’s cheaper than Tune protect and easy to enroll as well. The “visa letter” clearly states that COVID is covered.

Review: With their Nomad insurance you can pick how long you want your insurance for. They have a fantastic customer care chat/hotline as well.

Trawick International

COVID-19 EXPENSES are covered and treated as any other sickness.

*Travellers to and from the USA are not eligible

Example: The Cheapest Plan Coverage up to USD50k

Premium Estimation: To or From Malaysia (30 days) – $48.60 (about RM215) for 45 years old.

Duration: Extendable up to 2 years.

Age: Covers up to 99 years old. Persons age 80 to 99 and over are eligible for $50,000 plan only

Malaysian Residents

For Malaysians or Long Term Residents of Malaysia

AXA Malaysia

Summary of Benefit and Premium (Plan + Add-ons)

Pandemic Cover (Overseas trip only) Add-on: This covers for Trip Cancellation, Trip Curtailment, Medical, Hospital and Treatment Expenses, Hospital Allowances, Emergency Medical Evacuation, Emergency Medical Repatriation and Repatriation of Mortal Remains if you are diagnosed with a pandemic illness.

Premium of cheapest plan (Classic Plan): from RM45 + RM22 (Pandemic add-on) = RM67 for up to 31 days. Medical, Hospital and Treatment Expenses coverage up to RM50,000.

Age limit: 30 days old to 80 years old

Duration:

Single Trip Policy – Overseas Travel – each Trip duration must not exceed 190 consecutive days from the date of Commencement of the Trip

Annual Policy – Overseas Travel – each Trip duration must not exceed 95 consecutive days from the date of Commencement of the Trip

Review: I am flying to the UK in April & my office purchased travel insurance including add-on for pandemic cover (among other add-ons which you can choose) from AXA Malaysia.

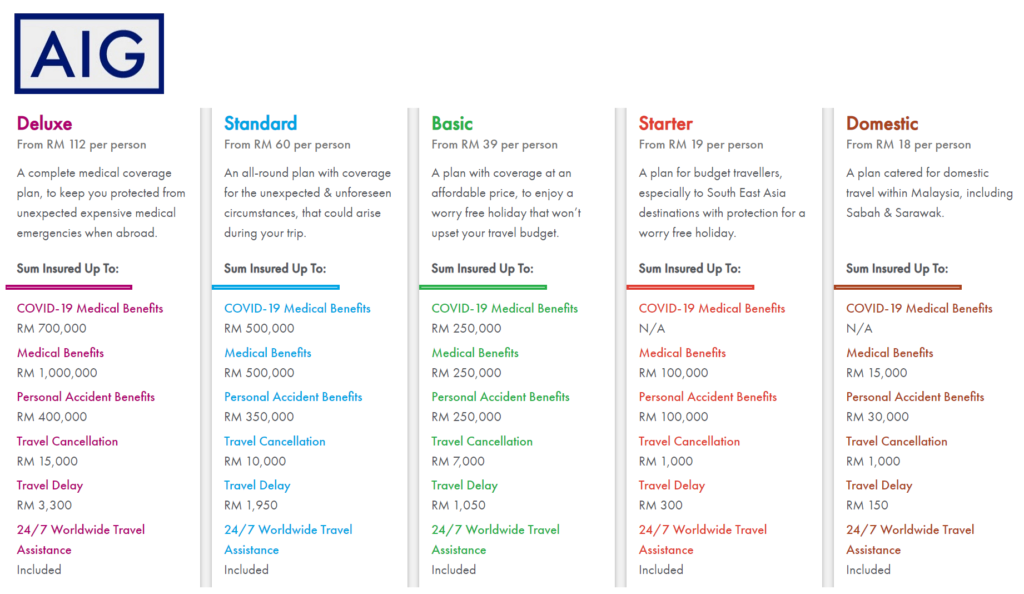

AIG Malaysia

Plans: From Basic Plan RM 151 per person (30 days) for COVID-19 Medical Benefits up to RM 250,000 to South East Asian Countries.

Eligibility: Only Malaysians and Permanent Residents are eligible for this travel insurance plan.

In the event you are diagnosed with COVID-19, they will cover you for COVID-19 coverages including Medical and Emergency Evacuation & Repatriation Expenses, Travel Cancellation, Travel Curtailment and Quarantine (test positive only) Allowance benefits (applicable to Basic, Standard or Deluxe plan only), conditions apply.

Max Duration: Up to 180 consecutive days for an overseas trip

Age: Covers up to 85 years old

(AIG Travel Insurance Policy Wording)

ZURICH Insurance – Z Travel Insurance (International)

zurich.com.my: Coverage for medical expenses for Basic Plan (cheapest up to 70 years old) is RM100,000

Example – Premium (Lite): from about RM88 + RM13 (Covid-19 add-on) = RM101 for 30 days (Basic Plan for single traveller 30 days old to 70 years old)

Age: 30 days to Senior cover from 71 – 85 years old

- Berjaya Sompo Insurance | All Malaysians, Permanent Residents, Student Pass Holders or Employment Pass Holders/Work Permit Holders legally employed in Malaysia who are aged between 30 days and 80 years old can buy | SOMPO TravelSafe provides you with up to RM500,000 protection against COVID-19 related complications and more.

- eTiQa Travel Insurance | etiqa.com.my – Can get the COVID-19 coverage add-on when you travel overseas. Note: Destinations with epidemic or pandemic under Level 4 are not covered. You may click on the link here: Travel Notices to find out more.

- Allianz Malaysia – Cannot find Covid-19 coverage plan on their website: Allianz Malaysia

From Singapore

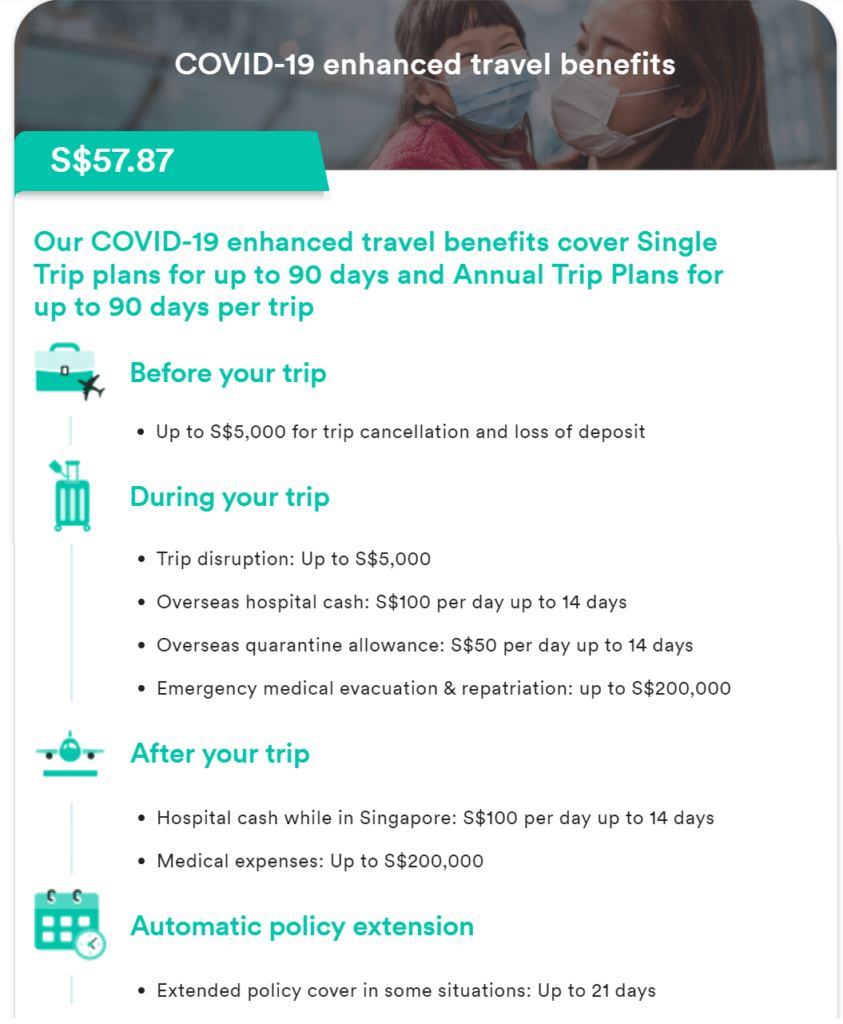

FWD

This is an example of plan with Covid coverage from Singapore to an ASEAN country for traveller below 70 years old on a 30-day single trip (after 20% discount). Total Premium = $55.20 + $57.87 (Covid) = S$113.07

FWD Sg Travel Insurance: Coverage with COVID-19 add-on: Up to S$200,000 in COVID-19 medical expenses incurred during/after your trip.

Duration: Single trip up to 90 days

Promotion: Use promo code TRAVEL20 to get 20% off, if the code is expired, check at: FWD Promotions to get a new code

Reviews: I bought fwd insurance for $104 two pax for VTL. We got FWD insurance. So far all good.

- AXA – Reviews: I purchased AXA Smart Traveller (Singapore) Essential annual policy. I felt it gave the best coverage at the most reasonable price. It even gives you some extra allowance if you’re hospitalized or quarantined due to covid. SGD 325+. One 30 day trip is already around $140+. If you plan to travel a few more times the coming year, an annual multi trip policy is probably more worth it.

- AIG – Travel Guard Sg: Up to S$250,000 in overseas Covid-19 related medical coverage if you are diagnosed. For example Basic Plan: S$83 (RM255) for 30 days (Covid-19 cover up to S$50,000)

- NTUC Travel Insurance | Buy Online NTUC – Review: Has added Covid Coverage worldwide. Select the country you’re entering. (Eligible only if your country of residence is Singapore). 1 week SG-Malaysia $40-65. 1 month SG-Malaysia $117-166.

- Singapore Airlines – Review Dec 21: I travel by SQ and add on their travel insurance by AIG, it covers up to sgd350k covid illness.

From USA

- AXA – Review Jan 22: Traveled from the US to LTB using AXA Assistance. I paid around $174 for 3 weeks.

- Generali Travel Insurance – Choose Plan Generali Global Assistance – Review Feb 22: I live in the US – came home to Malaysia in January – returning early March. I bought a Generali policy – very affordable and you can choose from 3 price options

- Allianz – Review Mar 22: I’ve used Allianz and had good experience for reimbursement! If you are travelling with kids, it is best to get a travel insurance. You just never know! My kid was hospitalized for a week and Allianz reimbursed me pretty swiftly when I filed a claim. Barely any questions asked – uploaded itemized hospital bill and thats was it!

- World Nomads – Review Mar 22: We have used World Nomads on all our travels. I had to unfortunately see a doctor on one of our trips and the reimbursement process was pain free. The coverage is pretty good, especially if you’re an adventurous travel. Paid out of pocket first for treatment then reimburse.

- Travel Insured International – I bought mine from Travel Insured International (www.travelinsured.com). Quite inexpensive.

- Etihad Airways – Review Mar 22: Check if the airline you are flying provides free covid insurance. I know Etihad Airways provides covid insurance up to 30 days from the date of travel.

From Indonesia

- Chubb Insurance | Chubb Travel Insurance International Indonesia: Covers Covid-19. Up to 85 years old – Comment (LTB): Flying from Indonesia to LTB, I have bought the insurance through CHUBB insurance.

From Thailand

- CIGNA Thailand – Review: CIGNA in Thailand offers oversea covid coverage for 41MYR/person/5day

From Canada

- BCAA – Covid-19 Coverage | Review: I did LTB from Vancouver (Canada) to Langkawi. I bought travel insurance from BCAA.

From the United Kingdom – UK

- HSBC Premier – Review: Travelling from UK to LTB, We used HSBC premier which has a link for you to get a certificate emailed to you – it has name and DOB and a specific section on Covid cover – it took about a day to receive.

- Tesco Bank Insurance – Review: If you are living in the UK, try Tesco Bank insurance. They specifically state covid 19 cover in their policy

- Post Office UK | Travel Insurance with Covid-19 Cover | about £66.92 for one month | No age limit | up to 365 days – Review: My son bought his travel insurance from the post office (UK) online and used his London address for the LTB last month and we travelled back to KL together. He is back home in London now.

From Australia

- Tick Travel Insurance | Review: Tick Travel Insurance was what I bought for Covid Cover travelling from Australia to Malaysia. It is acting as a General Insurance Distributor for the product insurer and issuer Mitsui Sumitomo Insurance Company, Limited.

- Medibank | Medibank Travel Insurance Covid-19 Benefits – Review Feb 22: I used Medibank. Medibank provides a separate letter explaining the policy covers some Covid related stuff (definitely medical) and that the amount is unlimited. The lady at the check in counter in Melb initially said I didn’t have the right insurance as it didn’t show the amount of $80k. I had to stress the word “unlimited” and hold my ground

. Once she double checked with a supervisor all fine.

. Once she double checked with a supervisor all fine.

From Switzerland

Allianz Switzerland – Review: You can buy quickly online through Allianz Switzerland. They have per trip or per year Covid insurance. Reasonable price.

For Insurance Quotations

- SquareMouth – Review: I bought mine from, their price is reasonable a bit cheaper from Tune.

Sources

Malaysia Air Travel Support Group

Malaysia Quarantine Support Group (MQSG)

For Malaysian Residents:

- AIG – Plans: From RM 39 per person for COVID-19 Medical Benefits up to RM 250,000. Only Malaysians and Permanent Residents are eligible for this travel insurance plan. In the event you are diagnosed with COVID-19, they will cover you for COVID-19 coverages including Medical and Emergency Evacuation & Repatriation Expenses, Travel Cancellation, Travel Curtailment and Quarantine Allowance benefits (applicable to Basic, Standard or Deluxe plan only). Domestic Trip: Each trip shall not exceed 30 consecutive days (Per Trip Plan).

- Berjaya Sompo Insurance | All Malaysians, Permanent Residents, Student Pass Holders or Employment Pass Holders/Work Permit Holders legally employed in Malaysia who are aged between 30 days and 80 years old can buy | SOMPO TravelSafe provides you with up to RM500,000 protection against COVID-19 related complications and more.