Selecting a mutual fund may seem like a daunting task, but doing a little research and understanding your objectives makes it easier. Identify your risk tolerance, evaluate the fund manager’s past results, the fund’s performance, history, fees, type, portfolio, turnover ratio, etc.

Channels to invest in Public Mutual. Each channel/ fund may have different fee structure :

1. Online via Public Mutual Online (www.publicmutualonline.com.my)

2. Online via KWSP i-Invest (using your KWSP savings)

3. Contact their servicing unit trust consultant

4. Go to the nearest Public Bank branch

There are fees and charges involved such as Sales, Redemption, Switching, Transfer Fee, Annual Management Fee, Trustee Fee. Investors are advised to find out about and consider them before investing in the Fund.

Click here for Announcement/ News about Public Mutual such as fund launching, distribution updates and notices.

Understanding Distribution

A unit trust fund distributes income to its investors in line with its declared distribution policy. Generally, fixed income/bond funds pay distributions to their investors on a regular basis, while distributions declared by equity funds may vary with market conditions.

Analyses and Tools

There are various tools, websites that you can use to do a bit of analyses before making a purchase:

*As of May 2021 (The data shown below serves as examples and may not reflect the current values)

Public Mutual Top Performing Funds

| Fund Name | Shariah Based | Nature of Funds | 10-Year Return (%) | 10-Year Annualised Return (%) | Fund Volatility Class (FVC) | 3-Year Fund Volatility Factor (FVF)# |

|---|---|---|---|---|---|---|

| PUBLIC GLOBAL SELECT FUND | – | Foreign | 178.10 | 10.76 | HIGH | 14.3 |

| PUBLIC ISLAMIC OPPORTUNITIES FUND | ✔ | Domestic | 173.25 | 10.56 | VERY HIGH | 27.0 |

| PUBLIC ISLAMIC ASIA DIVIDEND FUND | ✔ | Foreign | 155.90 | 9.84 | MODERATE | 14.6 |

| PB ISLAMIC ASIA STRATEGIC SECTOR FUND | ✔ | Foreign | 153.86 | 9.75 | HIGH | 15.9 |

| PUBLIC ASIA ITTIKAL FUND | ✔ | Foreign | 150.71 | 9.62 | HIGH | 14.6 |

| PUBLIC ISLAMIC ASIA LEADERS EQUITY FUND | ✔ | Foreign | 149.58 | 9.57 | HIGH | 16.9 |

| PB CHINA PACIFIC EQUITY FUND | – | Foreign | 147.69 | 9.48 | HIGH | 17.3 |

| PUBLIC CHINA ITTIKAL FUND | ✔ | Foreign | 117.66 | 8.08 | HIGH | 17.2 |

| PB ISLAMIC ASIA EQUITY FUND | ✔ | Foreign | 117.27 | 8.06 | MODERATE | 14.2 |

| PUBLIC FAR-EAST ALPHA-30 FUND | – | Foreign | 111.51 | 7.77 | HIGH | 15.0 |

| PUBLIC CHINA SELECT FUND | – | Foreign | 111.28 | 7.76 | HIGH | 17.1 |

| PUBLIC ISLAMIC SELECT TREASURES FUND | ✔ | Domestic | 105.36 | 7.45 | VERY HIGH | 20.3 |

| PUBLIC CHINA TITANS FUND | – | Foreign | 101.60 | 7.25 | HIGH | 14.3 |

| PUBLIC SMALLCAP FUND | – | Domestic | 100.89 | 7.22 | HIGH | 14.8 |

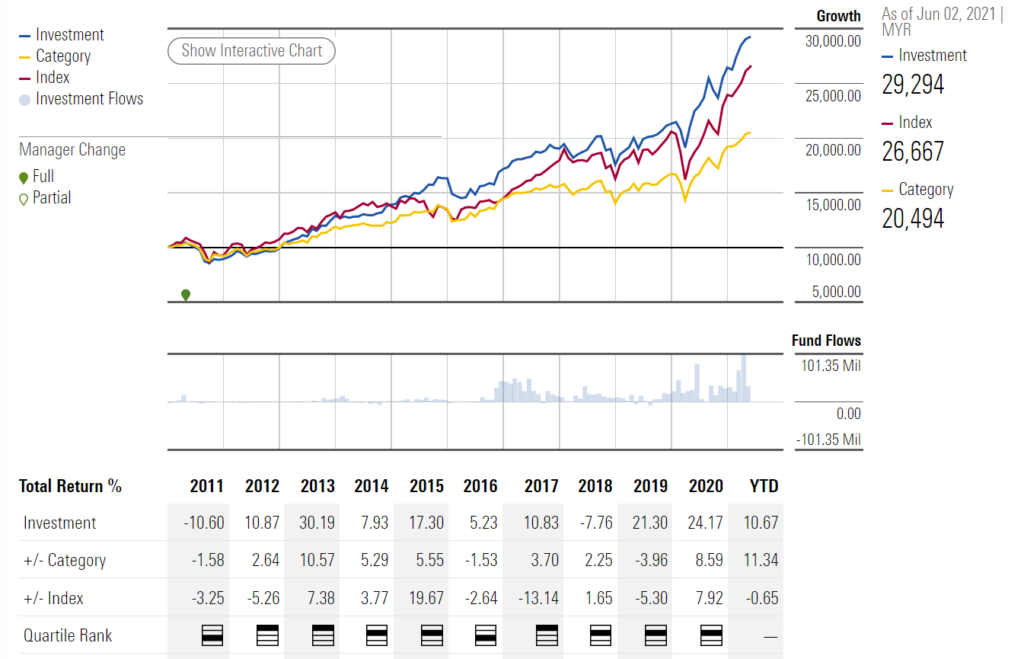

Performance

You can take a closer look at the data of for example the Public Global Select Fund on morningstar.com, the performance of this fund through the years:

The (cumulative) Total Returns % are calculated using NAV-to-NAV prices, with any income distribution reinvested.

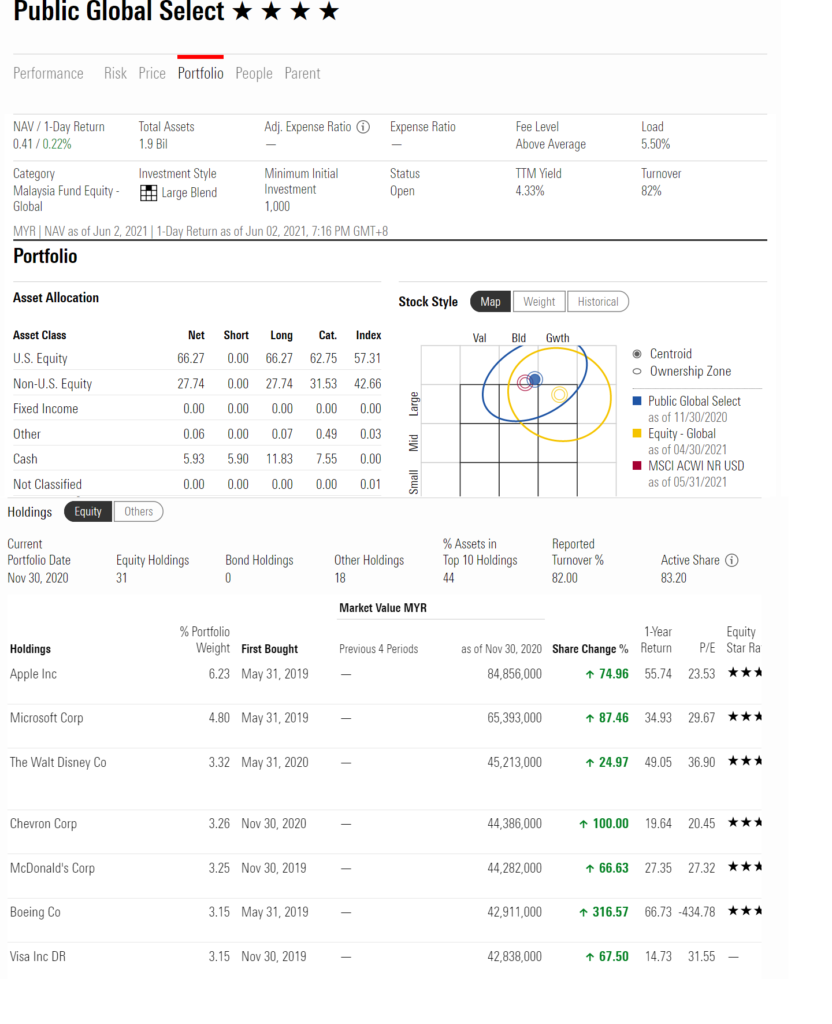

Securities Portfolio

The Portfolio of this fund; Asset Allocation, breakdown of the equity holdings invested, as well as by Sector; Technology, Communication Services, Financial Services, Industrials, etc. on morningstar.com.

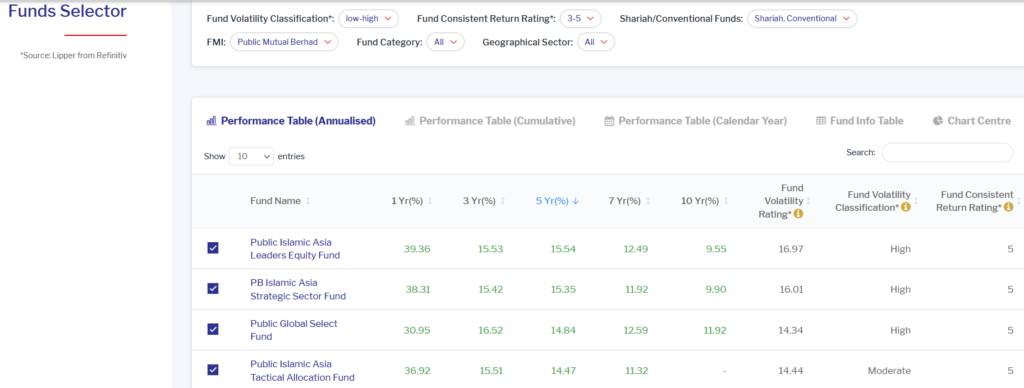

Funds Comparison

On kwsp.gov.my, login to your i-Akaun, and click on “Investment” from the top menu.

Select “Fund Tool” -> Funds Selector -> FMI: Public Mutual Bhd and select your preference -> hit “Generate Table”

You can choose the Table/ Chart: Annualised, Cumulative Performance, Calender Year Performance, Fund Info, Chart Centre.

Sort by performance (descending/ ascending), Fund Volatility and Consistent Return Rating.

More on KWSP i-invest.

Sources

morningstar.com

investopedia.com