Insurance coverage for damages caused by flood is usually not included in the motor/ car insurance and car owners who wish to protect their vehicles will need to pay an additional premium amount to include the Special Perils Add-On.

In the event of a need to claim, here are the Steps to expedite your claims

*Check with your ITO (Insurer/ Takaful Operator) for specific instructions

- Check the flood protection clause in your current policy/ certificate. A copy is required for the claim.

- Provide supporting evidence such as photos/ videos of the damage with the car registration number visible

- Make a police report with details of the damage within 24 hours

- Notify your ITOs or agents on your losses

MPI Generali

Website: mpigenerali.com | Tel: +603 2034 9888

Basic Comprehensive Private Car

Covers Loss or damage as a result of accidental collision, overturning, impact damage, fire, lightning, theft or malicious damage and third party liability for death, bodily injury and property damage, arising out of the use of the motor vehicle.

Special Perils Add-on

With the Comprehensive policy, subject to an additional premium, you can also choose to extend the coverage to include Special Perils: Flood, Typhoon, Hurricane, Storm, Landslip, Tempest, Earthquake, Volcanic, Eruption, Landslide, and Other convulsions of nature at 0.15% of sum insured (70% cheaper than tariff rates)

MSIG

Website: msig.com.my | Tel: 1-800-88-6744

The MSIG Lady Motor Plus and the MSIG Motor Plus Plans have Full Special Perils coverage already included. If you have the MSIG Comprehensive Private Car plan, you can opt for add-on. Product List and Buy Online.

Add-Ons

Covers the vehicle against damage caused by perils: Flood, Storm, Landslide, Landslip or Subsidence

Special Perils

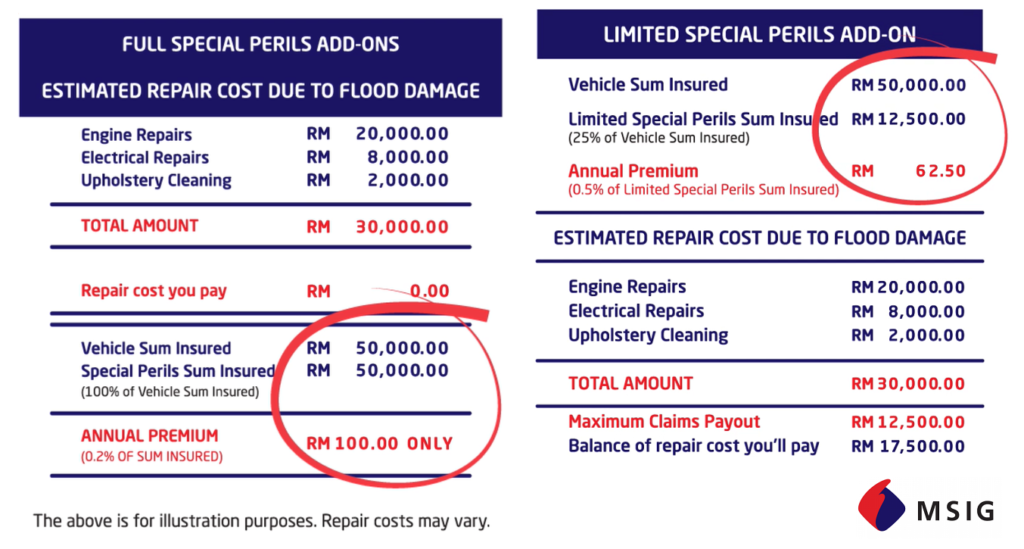

Premium charged: 0.2% x 100% vehicle’s sum insured

Maximum claims payout: 100% of sum insured

Limited Special Perils

Premium charged: 0.5% x 25% of vehicle’s sum insured

Maximum claims payout: 25% of sum insured

Tune Protect Motor Easy Insurance

Website: tuneprotect.com | Buy Online 10% discount) | Tel: 1 800 88 5753

PAY-AS-YOU-DRIVE – Up to 20% Refund (0 km – 6,000 km)

Flood Cover (Special Perils)

Get extra protection for your car in the event of flood, landslides, typhoon, storm, earthquakes etc. Get covered Super Affordably at 0.2% of sum insured.

In consideration of the additional premium for this endorsement (Special Perils), the insurance will cover loss or damage to Your Car caused by flood, typhoon, hurricane, storm, tempest, volcanic eruption, earthquake, landslide, landslip, subsidence or sinking of the soil / earth or other convulsions of nature.

Allianz

Website: allianz.com.my | Tel: 1800-22-5542

During the height of the floods in December 2021, the Allianz Road Rangers received requests from 1,393 customers whose vehicles were affected by the floods but of this number, only 68 had special peril cover (Source).

Special Peril Cover

Covers flood and other convulsions of nature. Cost: 0.2% of the vehicle’s agreed/insured value

eTiQa

Website: etiqa.blog | Apply Online (Save 10%)

With Etiqa, you can add-on the Basic or the Extended Flood Coverage plan to ensure protection against natural disasters. This would include a range of events including damage caused by a fallen tree.

Basic Flood Coverage – Floods and storms | Premium: 0.25% of the total sum insured/ covered

Extended Flood Coverage – Floods, storms, landslides, hurricanes, tornadoes, volcanic eruptions and other natural disasters | Premium: 0.5% of the total sum insured/ covered

Example

Sum insured: RM30,000 | Annual Premium: RM500

Option 1 – Cost of add-on Extended Flood Coverage: 0.5% x RM30,000 = RM150

The annual premium will be: RM650

Option 2 – Cost of add-on Basic Flood Coverage: 0.25% x RM30,000 = RM75

The annual premium will be: RM575

If the car is damaged by flood or other natural disaster, and the cost for repair is RM10,000, this amount will be paid to the owner of the insured vehicle.

The requirement for a police report under the Motor special peril claim will be waived for all flood incidents from 18 December 2021 onwards, effective immediately until further notice. Customers will only need to submit a scene photo of the vehicle damaged in flood with the car registration number visible (source)

How is the Premium of Motor Insurance Calculated

The total premium that you have to pay may vary depending on the cubic capacity of the vehicle, sum insured, no-claim-discount (NCD) entitlement, optional benefits required and the underwriting requirements of the insurance company

Other fees

Commission paid to the insurance intermediary (if any): 10% of gross premium

Stamp Duty: RM10.00 | Service Tax: 6% of premium